The Nominal Interest Rate Could Best Be Described as the

A higher nominal interest rate would then be charged in order to ensure the bank earned its actual interest rates. Loan G has a rate of 602 compounded semiannually.

14 Primary Resume With No Work Expertise

Usually if you are quoted an interest rate by a bank for a savings account it will be a nominal interest rate meaning in name only.

. 20 Real risk free rate. The rate that tells you what you really earn on an annual basis The rate that you use in calculations Its hard to say exactly The stated rate that ignores compounding The rate that if squared. A risk that investments value may change over time.

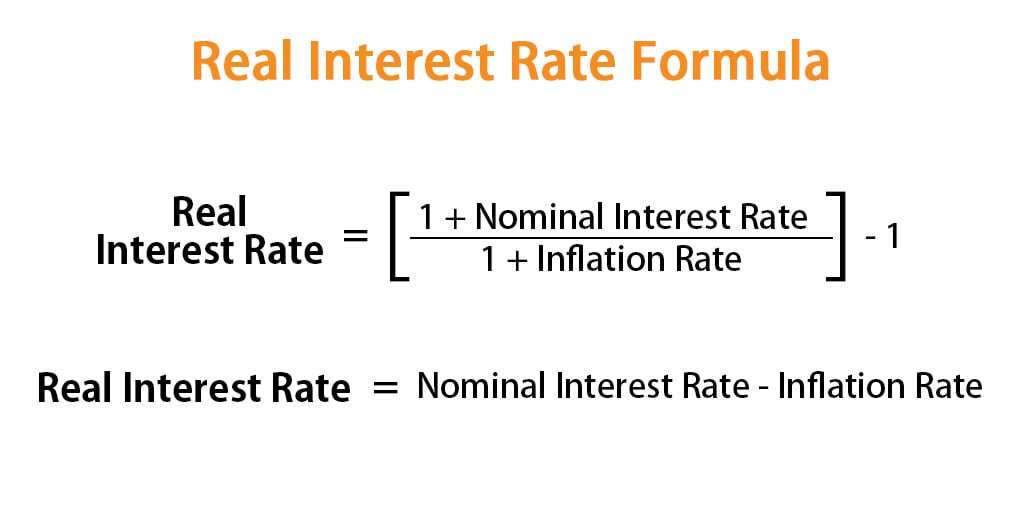

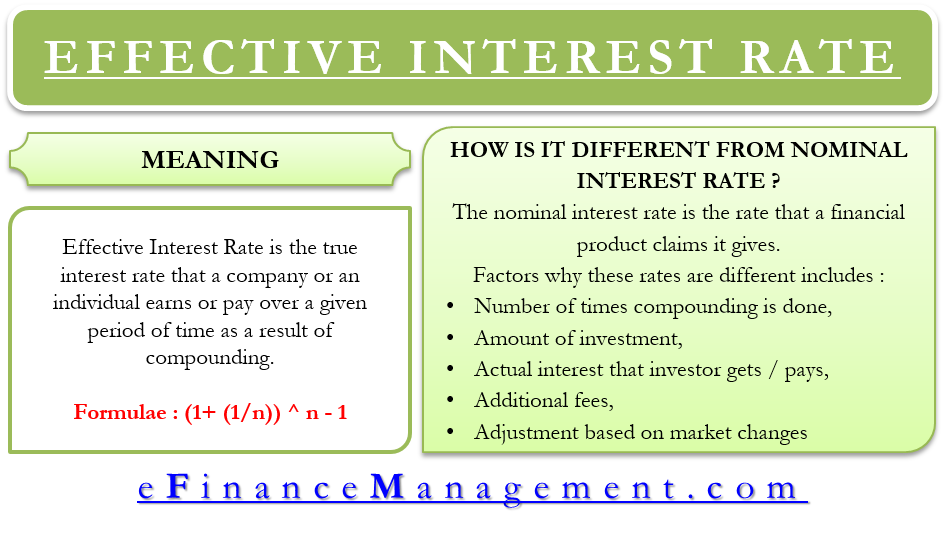

In terms of inflation adjustment the nominal interest rate differs from the real interest rate and the effective interest rate differs from the nominal interest rate in terms of compounding adjustment. The nominal interest rate could best be described as the rate. A nominal rate could best be described as.

The nominal interest rate is best described as the B specified rate. Thus the advertised or stated interest rates we see on bonds loans or bank accounts is usually a nominal one. A nominal interest rate refers to the interest rate before taking inflation into account.

Because of compounding you will actually receive more than 8 for a given year. The nominal interest rate describes the interest rate without any correction for the effects of inflation. Also the nominal interest rate is the real interest rate plus the expected inflation rate.

The change in the price level is added to the real interest rate to find the nominal interest rate. Following information is given about interest rate. Nominal Risk-Free Rate 1 Real Risk-Free Rate 1 Inflation Rate 1.

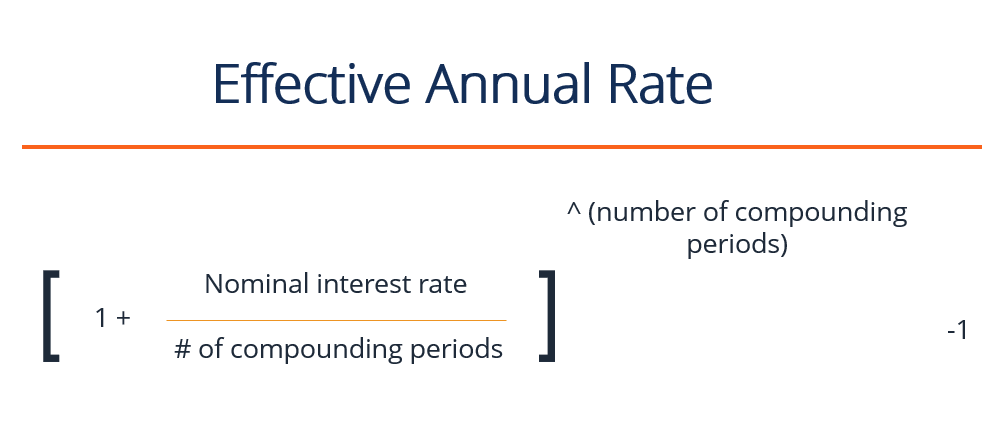

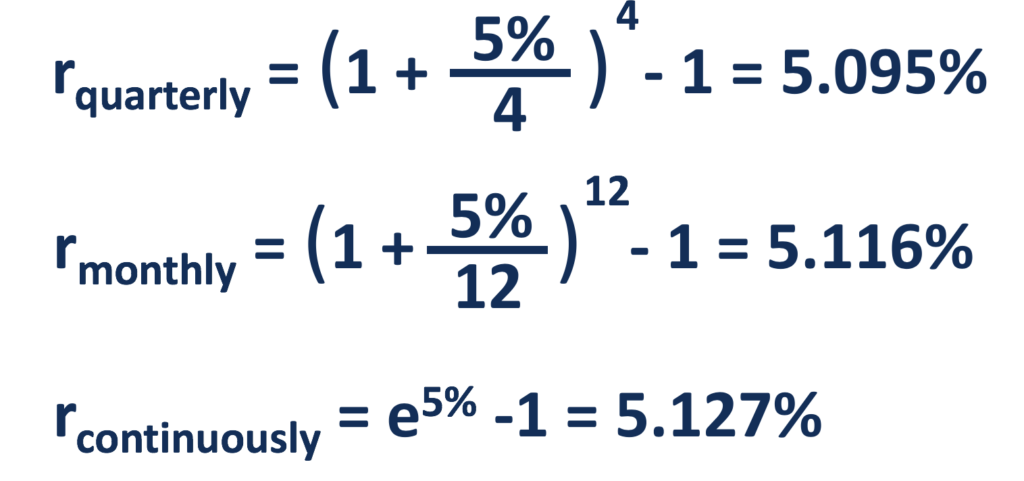

What is the difference between bank rate and interest rate. For example a nominal annual interest rate of 12 based on monthly compounding means a 1. The dollars future value changes.

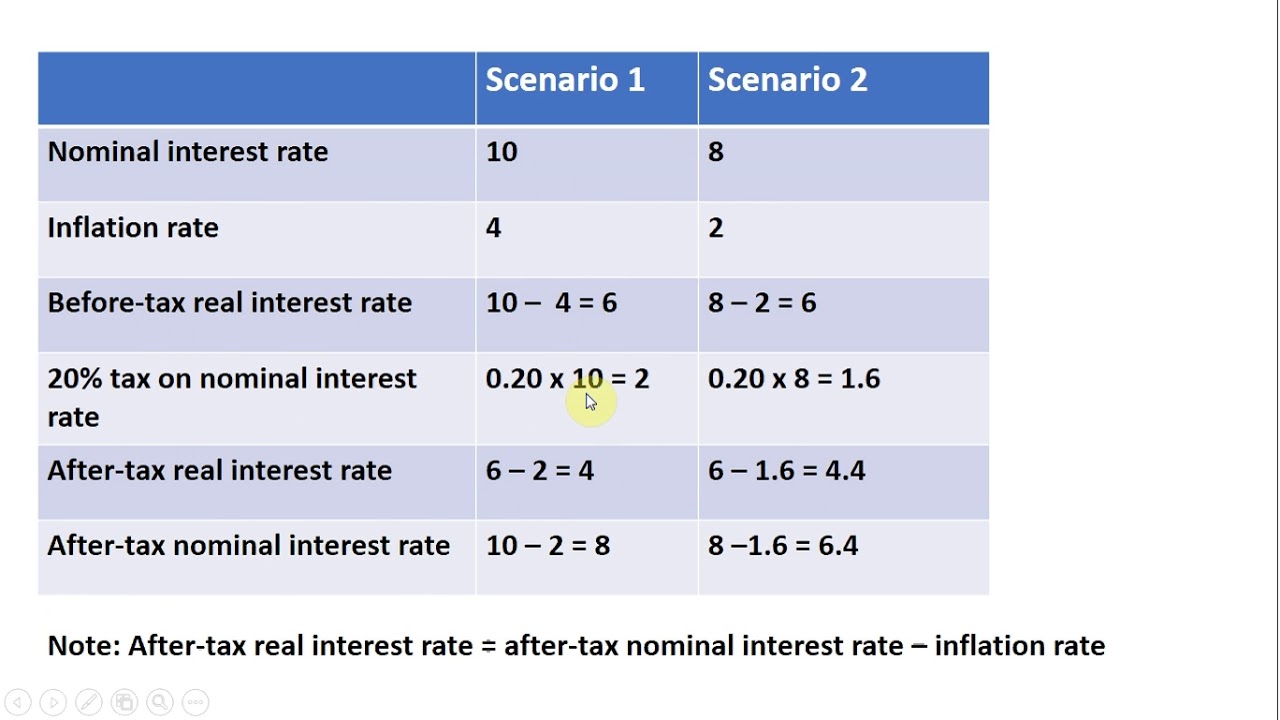

If for instance inflation was higher than the central bank anticipated it could have charged a higher nominal interest rate. Taxes are often owed on. Nominal in this context could be described as in name only whereas average would be the average or mean of actual measurements.

The nominal interest rate is the unadjusted stated rate of interest charged by the bank independent of any expected changes in the price level. Loan F has a nominal interest rate of 566 compounded monthly. Inability to sell a security at its fair market value.

The nominal interest rate is the specified interest rate on a deposit obtained by investors and a loan obtained by banks. Bank rate is a quantitative tool of credit control in the economy to control the situation of inflation and deflation whereas rate of interest is not a tool of credit control as it is not. Which statement best describes how inflation affects the value of investments over time.

Which loan will give the lower effective interest rate and how much lower will it be. Nominal can also refer to the advertised or stated interest rate. Here the nominal risk-free rate comes out to 82.

On the other hand a real term takes into account changes in price level over time. It also refers to the rate stipulated in the loan contract before compounding is taken into account. The nominal interest rate could best be described as the B Stated rate.

Nominal Risk-Free Rate 1 50 1 30 1. It decreases the value of money. Nominal interest rate is the interest rate before taking inflation into account in contrast to real interest rates and effective interest rates.

The nominal interest rate also known as an Annualised Percentage Rate or APR is the periodic interest rate multiplied by the number of periods per year. What occurs over time as a result of inflation. From those two assumptions well enter them into the formula to calculate the nominal risk-free rate.

The nominal interest rate could best be described as the _____ rate. When rates are quoted as nominal rates it is customary to provide 1 a stated rate per period and 2 the number of times interest is compounded during that period. This interest rate is unaffected by a countrys inflation rate so the rate is.

A nominal term is an unadjusted number of something such as wages stock prices assets and interest rates and is generally described in fixed monetary terms. An increase in the money supply that leads to an increase in expected inflation which in turn leads to an increase in nominal interest rates is best described as the. An investment with a stable and predictable history will most likely have.

A real interest rate is an interest rate that has been adjusted to remove the effects of inflation to reflect the real cost of funds to the borrower and the real yield to the lender or to an investor. This interest has not been affected by the inflation rate of a country therefore the rate is different than the actual interest. Check all that apply.

A nominal interest rate expresses the total interest paid in a period without considering the effects of compounding during the stated time interval. The nominal interest rate is the stated interest rate on a deposit which received by investors and on a loan which received by banks. Liquidity premium can be best described as compensation to investors for.

The nominal interest rate is the rate of interest before inflation is taken into account. If there is a sustained increase in the price level. Interest becomes worth less money.

Locking funds for longer durations. A nominal interest rate refers to the interest rate before taking inflation into account.

Calculating Before Tax And After Tax Real And Nominal Interest Rates Youtube

Calculating Before Tax And After Tax Real And Nominal Interest Rates Youtube

How To Use The Excel Nominal Function Exceljet

Nominal Interest Rate Overview Inflation And Compounding Adjustments

Nominal Interest Rate Definition Equation Video Lesson Transcript Study Com

Real Interest Rate Intelligent Economist

Us Interest Rates Farmdoc Daily

Why Have Negative Nominal Interest Rates Had Such A Small Effect On Bank Performance Cross Country Evidence Sciencedirect

Nominal Interest Rate Overview Inflation And Compounding Adjustments

Fisher Equation Overview Formula And Example

Real Interest Rate Formula Calculator Examples With Excel Template

Nominal Interest Real Interest And Inflation Calculations Video Khan Academy

Effective Annual Rate Definition Formula What You Need To Know

An Economic Theory Proposed By Economist Irving Fisher That Describes The Relationship Between Inflation And Both Real And Nominal Interest Rates The Fisher Ef

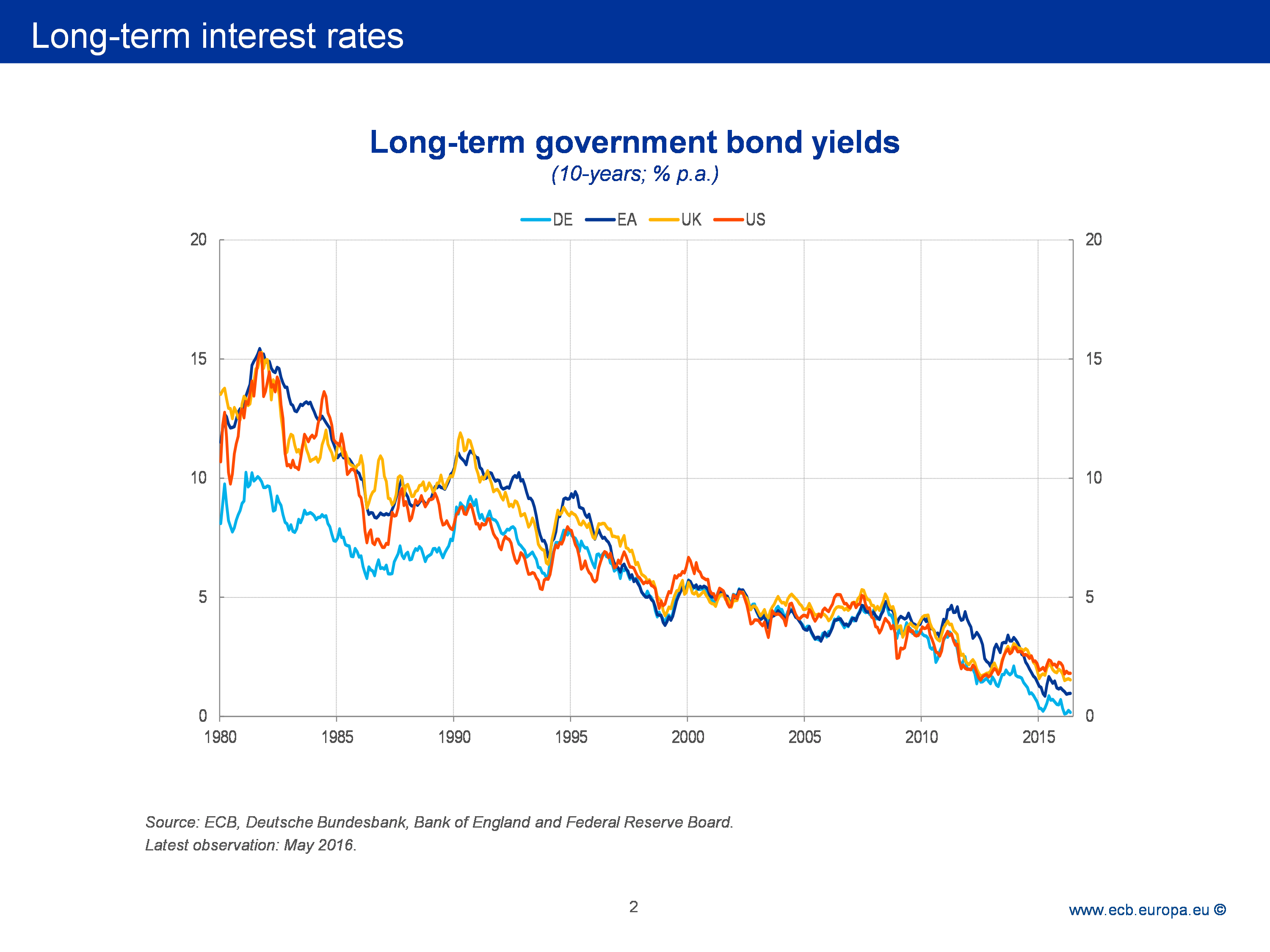

The Challenge Of Low Real Interest Rates For Monetary Policy

Effective Interest Rate Meaning Formula Importance And More

Nominal Vs Real Interest Rate Interest Rates Rate Real

Nominal Interest Rate Definition Equation Video Lesson Transcript Study Com

Comments

Post a Comment